Dow Jones Futures: Nvidia Stock Rises On Strong Earnings amal655

Dow Jones Futures: Nvidia Stock Rises On Strong Earnings amal655

Dow Jones Futures Surge Amid Nvidia’s Strong Earnings Report

The Dow Jones futures saw a significant uptick following a stellar earnings report from Nvidia (NVDA), reinforcing the stock’s stronghold in the semiconductor industry. The tech giant exceeded Wall Street expectations with robust revenue growth, driven by surging demand for its AI-powered Blackwell chips. This unprecedented demand has propelled Nvidia’s stock price, reinforcing investor confidence in the company’s long-term trajectory.

Nvidia’s Blowout Earnings: A Deep Dive Into the Numbers

Nvidia’s latest earnings report showcased record-breaking revenue and profit margins, with year-over-year growth exceeding analyst predictions. The company reported:

- Revenue of $22.1 billion, a staggering 265% increase compared to the previous year.

- Net income of $12.3 billion, an increase of 438% year-over-year.

- Data center revenue skyrocketing by 409%, primarily fueled by AI demand.

- Earnings per share (EPS) of $5.16, beating analyst expectations.

These figures highlight Nvidia’s continued dominance in the artificial intelligence (AI) and cloud computing sectors, positioning it as a key player in next-generation technology advancements.

Blackwell AI Chips: The Future of Computing

The unveiling of Nvidia’s Blackwell AI chips has sent shockwaves through the tech industry. The Blackwell series is designed to meet the ever-growing needs of AI applications, offering unparalleled computational power for deep learning and machine learning algorithms.

Why Blackwell AI Chips Are Revolutionary:

- Unmatched Performance: Blackwell chips boast twice the efficiency of their predecessors, making them ideal for AI and big data analytics.

- Lower Power Consumption: The new architecture significantly reduces energy consumption, making data centers more efficient.

- Cloud and AI Integration: Major tech firms, including Microsoft, Google, and Amazon, have already placed bulk orders for Blackwell chips.

This “amazing” demand for Blackwell technology signals a shift towards AI-driven enterprise solutions, reinforcing Nvidia’s pivotal role in the industry.

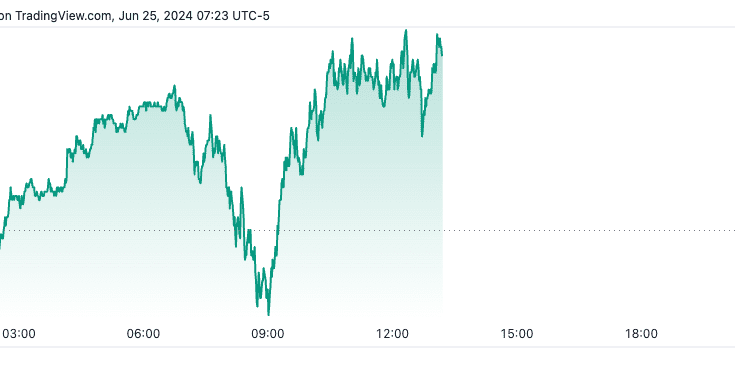

Stock Market Reaction: How Nvidia’s Earnings Impacted the Dow Jones and Nasdaq

The stock market reacted positively to Nvidia’s earnings report, with the Dow Jones Industrial Average (DJIA), S&P 500, and Nasdaq Composite experiencing significant movements:

- Dow Jones Futures: Up 0.85% in pre-market trading.

- S&P 500: Increased by 1.2%, largely driven by Nvidia’s strong performance.

- Nasdaq Composite: Surged by 2.3%, reflecting investor optimism in tech stocks.

Nvidia’s stock jumped over 10% in after-hours trading, signaling bullish sentiment among investors. Market analysts believe that Nvidia’s growth trajectory will continue, as demand for AI and high-performance computing (HPC) solutions remains strong.

What This Means for the AI and Semiconductor Industry

Nvidia’s impressive earnings have broader implications for the AI and semiconductor sectors. The company’s dominance has set a new industry standard, impacting major competitors like AMD, Intel, and Qualcomm.

Key Takeaways for the Semiconductor Industry:

- Increased Investment in AI Infrastructure: Nvidia’s Blackwell chips have encouraged global firms to ramp up their AI investments.

- Competitive Pressure: Rivals such as AMD and Intel are racing to develop AI-driven GPUs to compete with Nvidia.

- Supply Chain Strengthening: The demand surge has led Nvidia to expand partnerships with TSMC and Samsung to ensure a stable supply of advanced semiconductor chips.

The AI revolution is fueling demand for high-performance GPUs, and Nvidia’s stronghold in the market ensures continued growth in the AI and cloud computing sectors.

Investor Insights: Is Nvidia Stock a Buy?

With Nvidia’s earnings report shattering expectations, investors are now wondering if NVDA stock is a buy. Here are the key factors to consider:

Pros of Investing in Nvidia Stock:

- Unmatched AI Dominance: Nvidia remains the leading player in the AI chip market.

- Strong Financials: Revenue growth and expanding profit margins indicate long-term stability.

- Robust Institutional Demand: Major corporations are integrating Nvidia’s GPUs into their AI frameworks.

Potential Risks:

- Regulatory Scrutiny: Government regulations on AI and semiconductor exports could pose challenges.

- Market Volatility: Nvidia’s stock has seen rapid fluctuations, requiring investors to stay cautious.

Despite potential risks, most analysts have issued a “strong buy” rating for Nvidia, emphasizing its leadership in AI and semiconductor technology.

The Road Ahead: Nvidia’s Future Prospects

As Nvidia continues to push the boundaries of AI and computing, its future remains exceptionally bright. The company’s roadmap includes further advancements in AI infrastructure, deep learning models, and enterprise solutions.

Key upcoming developments include:

- Expansion of the Blackwell AI chip series.

- Increased partnerships with leading cloud providers.

- Further innovation in autonomous driving and robotics.

- Dow Jones Futures: Nvidia Stock Rises On Strong Earnings amal655

Conclusion: Nvidia’s Growth Story Continues

With record-breaking earnings, unprecedented demand for Blackwell AI chips, and an optimistic market reaction, Nvidia remains a dominant force in the tech industry. The company’s stronghold in AI, cloud computing, and semiconductors solidifies its position as a top investment choice for tech-focused investors. Dow Jones Futures: Nvidia Stock Rises On Strong Earnings amal655

For those looking to capitalize on AI-driven stock growth, Nvidia remains an essential player to watch. The company’s financial strength, innovation, and market leadership continue to fuel its upward trajectory.